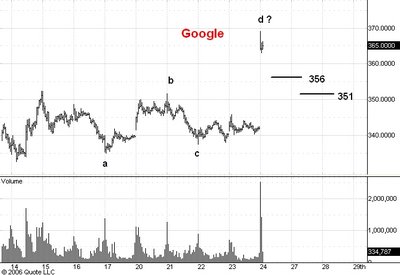

Here is a 15 minute chart of Google.

After the close yesterday it was announced that on March 31 GOOG will join the S&P 500 index. I have to admit that this rubs my contrarian nerves the wrong way.

For one thing, it is a solid piece of evidence that the bull market in the averages is nearing its end. My prediction has been for a top on April 25 with the potential of delaying that until June 5. So the Google announcement adds to my confidence that the upswing to 1350 will be the last of the bull market which started in 2002.

As far as GOOG itself goes, this is good news in the short run but looking ahead more than a couple of months I think it means that 475 was the bull market top in GOOG. The best we can expect now is a rally into the upper 1/3 of the 331-475 trading range, perhaps to 440 or so, followed by a break below 300 in GOOG.

I still think the 331 low reached on March 10 will hold and that the market is on its way to 44o or so. Looking at the chart above this post you can see that the swing from c to d is longer in price than the swing up from a to b. If GOOG is as strong as I think then any reaction from today's high should be no greater than the length of the swing down from b to c, i.e about 13 points. This would put support near 356. My secondary support is at 351 at which price a drop from 369 would be 18 points, the length of the biggest reaction so far in the move up from 331.

No comments:

Post a Comment