This week both Time Magazine and The Economist published cover stories which caught my attention. The first picture above this post is the Economist cover, the second is the May 27 Economist cover, and the top picture is the Time Magazine cover.

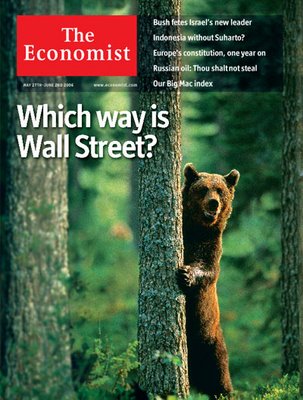

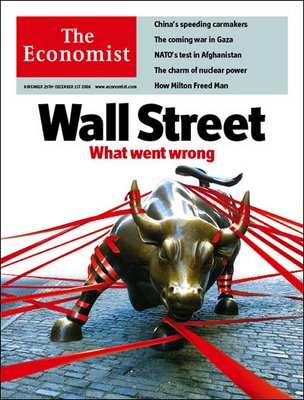

Take a look at the two Economist covers. The May 27 cover depicts a bear and the November 25 cover depicts a bull. At the time the May 27 cover was published I pointed out its bullish import. Now, 6 months later, I think the bull on the November cover is telling us that the rally from the June- July lows is nearly over. The next 100 point move from where the S&P trades now will probably be downward.

But in addtion to this I think both Time and The Economist are telling us something about the bigger picture, the longer term prospects for stock prices in the USA.

Note that even while the November 25 Economist cover depicts a bull, it is a bull hamstrung by ribbons of red tape. The cover headline (in the classic colors of fear - red and black) screams "Wall Street - What Went Wrong?"

The Time magazine cover is even more explicit. It depicts Mr. Everyman about to tumble into a chasm he fails to see. The headline asks "Why We Worry.....". The Time logo appears again in the classic colors of fear, red on black, with the "i" replaced by a bolt of lightening.

Neither this Time cover nor the Economist cover are covers I would expect to see near the start of a severe bear market. They show that public attitudes towards the stock market and towards life in general are fearful. From this I conclude that any drop in the averages we see during 2007 will be relatively mild, probably less than 20%. At the low I think we shall see as much or more bearish sentiment than was seen at the 2002 bear market lows. This in turn will set up an extremely strong bull market for 2008 and 2009.

4 comments:

I don't think either cover has anything to do with the stock market, but other sentiment indicators are pretty giddy anyway, like Investors Intelligence.

Carl, how do you reconcile your view of Domed House pt. 17 vs. your statement of a 100pt S&P drop in the near future? Is this within the bounds of the DH theory?

Thanks.

You prediction sounds like the best case scenario. Priced for perfection. As if Sohpie never had to make her choice, and got to keep both children. What will it be, the dollar or the domestic economy? Both? Neither? This country is drifting like an aircraft carrier with no engines. Heavily armed and heading nowhere. Where exactly is the leadership going to come from to make your prediction work? Right now the greedy and the risklovers are running the show. Accommodation is great if you aren't accommodating sloth and greed.

I am not convinced. There is lots of global growth out there, the world no longer revolves around the USA. Japan is looking up for its first time in nearly 20 years. Germany, the powerhouse economy of Europe is also starting to move for its first time since I can remember. China and India are powering ahead at a rate of around 10%. What is different this time is that in all these economies are experiencing domestic demand. If the dollar falls, America will be able to export itself out its problems. I see very little danger of stock market crash.

Post a Comment