Here is an image of today's front page in the

New York Times. The headline reads "Slide on Wall St. Adds to Worries About Economy."

I couldn't find an image of the

Chicago Tribune's front page (

added later: Mike pointed me to the image of the

Tribune's front page you see above; thanks, Mike!) but the headline read "China Market Plunges, Dow Follows. Now What?" The front page of the

Tribune's business section was devoted to yesterday's mini-crash. Three subheads in this spread were: "Global Markets Plummet", "Some Traders Fear the Worst", and "Analysts Argue Sell-off Could Be Reality Check, Sign of More to Come".

But the most interesting development occured last night on

NBC's Tonight Show with Jay Leno. Leno opened his comedy monologue by observing that if you had money in the stock market, you didn't anymore because "the market dropped 500 points today".

Now I have found the

New York Times and the Chicago Tribune to be reliable fades, especially when they highlight bearish news. But the most reliable fade of all is

Jay Leno. During the summer of 2002, the greatest buying opportunity of the past 10 years, Leno made jokes about the stock market almost every night, all along the lines of how much money investors were losing.

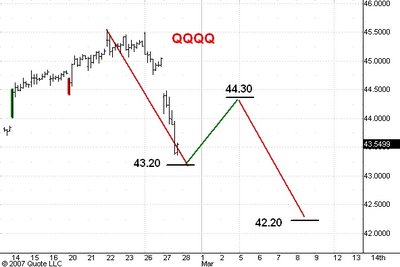

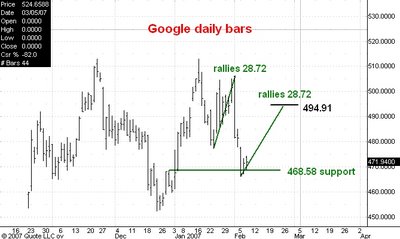

Remember that the mainstream media are in the business of telling people what they want to hear. They are at the same time opinion leaders and opinion formers. With this in mind I think it is safe to conclude that the drop from last week's high is NOT the start of even a 15-20% decline. Instead I think that most of the drop has already been seen and that the US stock market will make new bull market highs in the weeks ahead.