My casual impression gleaned from reading blogs and other stock market commentary is that technical types are seeing many "divergences" in the US stock market. For this reason they have been selling all the way up from the S&P low at 1168 on October 13.

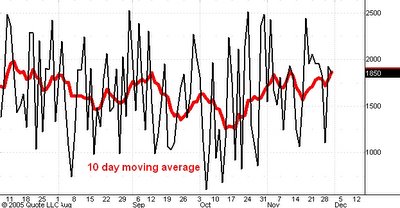

Here is a chart of the Rydex Cash Flow Ratio maintained by

Decisionpoint.com. The blue line is the daily value of the ratio and the red line is its 20 day exponential moving average.

I last commented on the Rydex Ratio here. Recall that high values of the ratio (which show up as low levels on the chart because of its inverted scale) mean that market timers are moving relatively large amounts of money out of stock market bull funds into bear funds and cash. From a contrary opinion point of view such a situation offers a bullish prognosis for stock prices.

At the October low this Rydex ratio reached the highest level in the past 5 years (i.e. showing the lowest level in 5 years on the chart). This is an extreme level of bearishness and is one of the factors that gave me confidence that a big rally was imminent then.

Right now the red line (20 day exponential moving average) is at 0.84, still quite a ways from its July '05 level of 0.76 and even further from its January '05 level of 0.62. Yet the S&P 500 is at new bull market highs for the move up from its 2002 low at 768. I think

this divergence is telling us that there are still too many bears out there for the upmove to end and that substantially higher prices will be seen during the next few months.