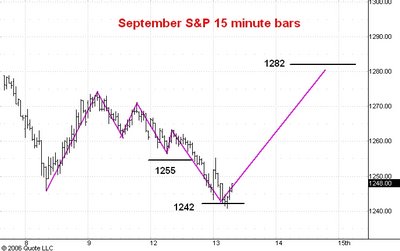

Here is a daily chart of the Dow Industrial average going back to the start of the major three peaks and domed house formation which is underway. I have been tracking George Lindsay's Three Peaks and a Domed House formations in the Dow and the S&P. You can read my real-time analyses here.

I think that the June 14 low in the Dow was point 26 of the major formation. There is so much unreasoning bearish sentiment in the US stock market that I think the rally to point 27 will carry the average to new bull market highs. My best guess is for a top near 11900 which would be a new historical high for the Dow as well.

There is another reason for thinking the move to point 27 will make a new high for the bull market. On the chart I have labeled in red numerals a minor example of a three peaks and domed house. In this minor formation the June 14 low is point 10. The June 28 low is point 14 and completed a very symmetrical "base" in Lindsay's terminology. This increases my confidence that this minor formation is a valid one. The domed house should carry the average above the highest of the three peaks. So this minor formation is predicting a new bull market high dead ahead.

When might the upcoming top occur? The 7 month, 10 day standard time interval from blue point 14 timed blue point 25 in my opinion. So the standard interval in the major formation is not helpful here.

The standard time interval in a minor (red) formation is harder to apply since the interval is not likely to start at red point 14. My best guess is that point 23 of the minor formation (and point 27 of the major formation) will develop about 7 months and 10 days from either red point 4 or red point 6. This predicts a bull market top for either August 30 or November 27 of 2006.

In any case, after point blue 27 and red 23 is in place Lindsay's theory says that the market should drop to the start of the major (blue) formation. This in my opinion is the 9708 level which marked the October 25, 2004 low in the Dow. This would be about a 20% drop from the projected top near 11900.