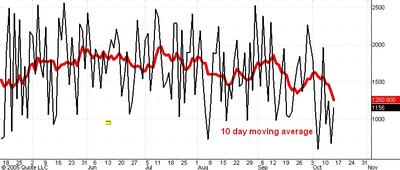

Last week I commented on what I thought was an emerging divergence in the advancing issues numbers which would have indicated that a low was at hand. As you can see in the chart above the potential divergence in the 10 day moving average of this number was eliminated today as it fell to the level reached in March of this year. The daily numbers are still showing a small divergence but I don't like to rely on them alone.

Right now I think we have seen the worst of the daily numbers and another low tomorrow around 1167 in the S&P accompanied by a daily number of advancing issues above today's level of 1156 would be a very bullish indication.

Looking further ahead, there is a 50-50 chance that after a 30 point rally in the S&P we will see somewhat lower lows which will be accompanied by higher readings in the 10 day moving average. If this occurs it will be an extremely bullish indication but in my experience only about half of the important low points in the averages are accompanied by this sort of divergence, so we can't count on it.

No comments:

Post a Comment