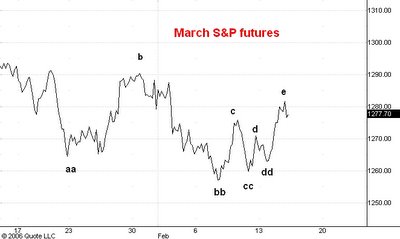

The first chart you see above this post shows the hourly closes in the March S&P futures together with labels which denote the swing extremes I think are relevant. Yesterday I discussed some considerations useful for analyzing such a chart.

Right now the upswing from cc to e has exceeded in time and extent the preceeding upswing from bb to c. This tells me that the entire swing up from from bb is incomplete. Since it is already almost as long as the swing up from aa to b I conclude that it will soon exceed the latter swing and when it does we will have (late) confirmation that the low at bb ended the reaction from the January 11 top.

The second chart above this post is a hourly chart of pit activity in the March E-mini S&P futures. One thing I like about electronic contracts like this one is that one gets real time volume of trading numbers instead of "tick" volume numbers. These volume numbers appear as bars at the bottom of the chart and the blue line is a 7 period moving average of the volume bars.

One of the principal tenets of technical analyis is that volume shows the trend. In other words, as a trend progresses it tends to show an increase in trading volume. If this doesn't happen one has a warning that the trend may be near its end. In general, comparing volume on succeeding swings often is a way to get an early read on the possiblity of a trend reversal.

On the chart of the E-minis I have compared the volume trend on the current swing up from point bb to the preceeding swing up from point aa to point b. The blue letters B identify the price and volume trends for the upswing from bb while the blue letters A do the same for the upswing from aa.

The important observation here is that volume has shown a definite tendency to increase on the rally from bb while on the rally from aa it showed a definite tendency to decrease. This tells me that the swing up from bb is the "real deal" and that new bull market highs will soon be seen in the S&P.

No comments:

Post a Comment