As you know I am a big believer in the methods George Lindsay used to predict the stock market. You can read

all my George Lindsay posts here.

But the stock market was only one of George Lindsay's interests. He also devoted a great deal of effort developing what he called the "technical analysis of history". This involved connecting apparently disparate events in the economic, political and cultural life of a nation via certain fixed periods of time. Lindsay wrote a book about some of his methods entitled "The Other History" which unfortunately is now out of print.

One of Lindsay's theories is that every nation goes through repeating periods of approximately 400 years in length. During the first 300 years or so the nation's political, military, and economic strength increases on average, but during the last 100 years or so the nation goes through a period of decline.

I like to date the emergence of the United States as a national concept from 1770, about 4 years prior to the start of the Revolutionary war. Lindsay perferred the date of 1791. According to Lindsay's theory one would then expect the political, military, and economic power of the United States to increase on average until 2070 or 2091. It is not a great leap of faith to then expect that US stock prices would also moving upward on average during this same period of time.

I think this prediction derived from Lindsay's technical theory of history should be of interest to Elliott wave afficianados. As far as I can determine most Elliott theorists believe that an upwave of Grand Supercycle degree began in USA stock prices in the late 1700's. Robert Prechter dates the beginning of this Grand Supercycle degree wave from 1784.

As is well known Prechter had been expecting the top of the Grand Supercycle upwave to develop at various times; the earliest such predicted top was 1987 . It is my understanding that, at least until recently, he believed that the Grand Supercycle top had actually occurred in 2000.

I believe that this expectation of an imminent Grand Supercycle top is

not consistent with Lindsay's theory of the 300 year expansion period which for the United States should continue at least until the year 2070 and possibly until 2091 or even later. But what I find interesting is that there is a simple ALTERNATIVE Elliott expectation which

is consistent with both Lindsay's and with Elliott's theory.

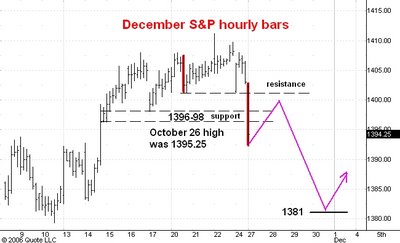

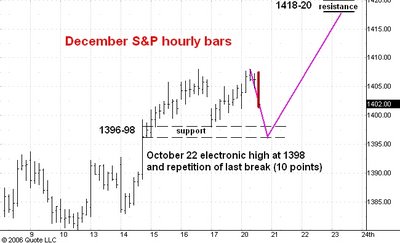

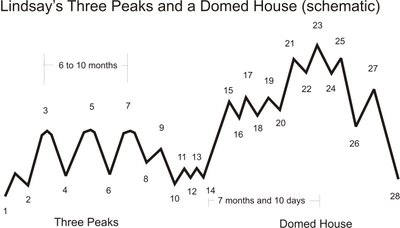

This

alternative expectation is illustrated above this post. It calls for the fifth and final wave of the Grand Supercycle upwave from 1784 to be an extended wave of Supercycle degree. If the Grand Supercycle has an extended upwave as its fifth wave the whole move upward from 1784 will probably look like a 9 wave sequence (5 up and 4 down) instead of the standard 5 waves (3 up and 2 down). Put another way, one would expect to see within the Grand Supercycle four really big corrective waves. So far we have seen three: 1835 t0 1857, 1929 to 1932, and 2000 to 2002. The fourth would probably develop sometime during the second third of this century.

Here is some evidence which relies on "repeating time intervals" to support this prediction.

The 1835 top developed 51 years after the start of the Grand Supercycle. The 1929 top developed 72 years after the supercycle low in 1857. The 2000 top developed 68 years after the supercycle low in 1932. The median number is 68 years and adding this to the 2002 low then predicts a top for 2070.

Here is some Fibonacci evidence. Adding 144 years to 1784 give 1928, the date of the "orthodox" Elliott wave top in 1928. Adding 144 years to the 1857 supercycle low give 2001, one year after the 2000 top. And adding 144 years to the 1932 supercycle low gives 2076 as the year of an important top.

So I think that Mr. Lindsay and Mr. Elliott might agree on the following prediction. The US stock market is nowhere near the top of the current grand supercycle wave which began in 1784. Instead US stock prices are in the early stages of a 68-72 year upmove which will take the averages to levels making today's prices look very, very low by comparison.