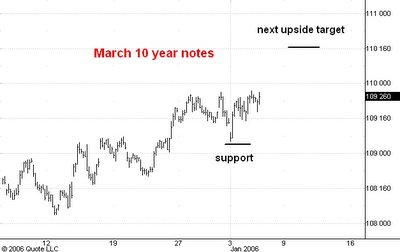

Here are hourly charts showing pit trading in the March t-bond futures and the 10 year note futures.

I have been thinking that the bonds would drop to 113-08 before resuming their rally but I have changed my mind about this. The sequence of three higher hourly lows beginning with the 113-25 low on January 3 tells me that the market is heade up to 115-28. That level could well end the rally from the November 4 low at 110-12 in the December '05 contract.

The notes are headed up to 110-16. I now think that too will end the rally in the notes and that the 111 level will not be reached.

1 comment:

carl:

could you give your views on BOT? looks like all it does with analysts comments is going down every day..

market is going up and the stock does the exact opposite.any thoughts? thanks

Post a Comment