I think the most remarkable thing about the bull market which started in October 2002 from the S&P 500 low at 768 is the unwillingness of investors to enjoy their good fortune. After every modest drop in the averages during the past three years bearish sentiment has emerged quickly and has risen to levels normally seen only at bear market lows. Evidently the scars of the 2000-2002 bear market run deep.

In judging the state of market sentiment I place much more emphasis on what the average member of the public thinks than on "expert" opinion. That is why I like to gather evidence for my "contrary opinion" analysis from the news media rather than from surveys of expert opinion.

There is an interesting source of data about the views of "John Q. Public". It is the Ryex cash flow ratio compiled by DecisionPoint.com. (You have to be a subscriber to access this data but I think the $20/month cost is a bargain!)

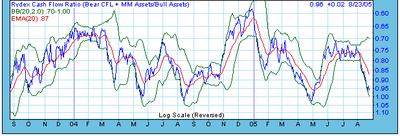

The cash flow ratio has as its numerator the sum of the cash flow into Rydex bear funds plus the level of assets held in Rydex money market funds. This sum is a measure of the intensity of bearish sentiment. The denominator of the ratio is the level of assets held in Rydex bull market funds and dividing by this denominator serves to "normalize" the numerator so that comparisons across time are easier to make.

The chart above by DecisionPoint.com shows the Rydex cash flow ratio over the past two years. The scale is inverted so that high levels of the ratio (associated with high levels of bearish sentiment) show up at low levels in the chart, etc.

The most striking thing about this chart is that the Ryex cash flow ratio is now very close to the levels it reached last April and also in August 2004. Both were important intermediate term low points in the S&P and good times to put cash to work in stocks. The reason this current level of bearishness is remarkable is that the S&P 500 has dropped only 30 points from its July top as compared to the 100 point drops in the previous two cases cited.

This shows that "John Q. Public" is trying to pick the top of the current bull market. I don't see how he can succeed in this effort. This gives me a lot of confidence in my bullish stance.

No comments:

Post a Comment