For the past few days the September S&P futures have traded above and below the low of the box at 1224. I think this market is headed up from the low we made today at 1217.70.

I have a number of reasons for this prediction but perhaps the simplest one is the behavior of the New York Stock Exchange advancing issues number. I have recently commented on this indicator here and here.

The first chart above this post is an updated hourly chart of the September S&P futures. It has dropped nearly to its August 18 low at 1217.40 and may well break that low by a bit later today.

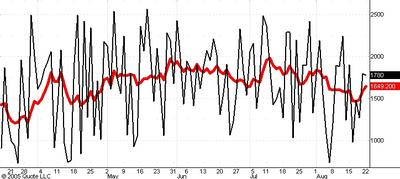

The second chart shows the daily number of NYSE advancing issues (black line) and the 10 day moving average of this number (red line). You can see that as the market has traded sideways the past few days the daily advancing issues number has made higher lows. Moreover, the 10 day moving average has already turned upwards.

So we see some subtle signs that the general market is strengthening even as the S&P is trading sideways to down. Since I am bullish on the longer term trend I feel comfortable interpreting this as a sign of an imminent low point.

No comments:

Post a Comment