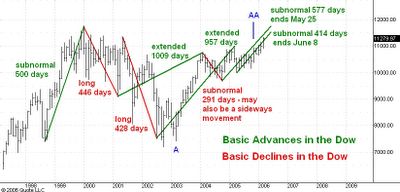

George Lindsay often asserted that there was a great deal of regularity in the duration of bull market advances and bear market declines. He believed that his theory of Basic Advances and Basic Declines, when coupled with simple technical methods based on the number of advancing issues on the New York Stock exchange, outperforms any other timing method.

Basic Advances and Basic Declines are intervals of time, usually (but not always) starting at bear market lows and bull market highs respectively. Lindsay observed that the durations of these time intervals seemed to cluster around certain specific numbers. He grouped these numbers into categories. For example, a basic advance could either be subnormal, normal, long or extended. He made several other observations about basic advances and declines which help to anticipate the length of the current one. For more on this theory you should read Lindsay's article "Counts from the Middle Section"

which is reprinted in the booklet "Selected Articles by the Late George Lindsay".

The chart above records the monthly ranges of the Dow Jones Industrial average since 1998. I have drawn green and red lines on the chart showing my current estimates of the postions of Lindsay's basic advances (green lines) and declines (red lines).

In my

2003,

2004,

2005 , and

2006 stock market forecasts I worked under the hypothesis that a basic advance began in March 2003 at point A in the chart above. If this were correct then this basic advance should have ended after March 2005 but no later than December 2005, point AA in the chart. As you can see the Dow has gained strength during these first three months of 2006 and this has convinced me to set aside this hypothesis.

Instead I now think that the Dow is nearing the end of two subnormal basic advances, one which began from the October 25, 2004 low and the other from the April 20, 2005 low. Both these subnormal advances followed on the heels of extended advances as they should. I think subnormal advances make sense here because any longer advance would put the top further away from the 15 year, 3 months projection of a major top for January 2006. Longer advances would also be inconsistent with the imminent completetion of the

Three Peaks and a Domed House formation.

The best agreement I can come up with for the end of these two subnormal advances is the May 25 - June 5 2006 time period. This is spot on with the standard time projection from point 14 of the Domed house of 7 months 10 days. This makes me think that my projection of a bull market top for April 25 is now somewhat less likely to be correct than the projection of a top for roughly June 5.