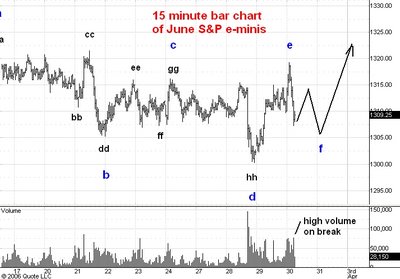

Here is a 15 minute bar chart of the June S&P e-mini futures.

A little before the pit opening this morning the market dropped to 1309 support and after the opening rallied to 1319, just a shade under the 1321.50 bull market high.

The subsequent break occurred on high volume and broke a little below 1309 support. The high volume means that we haven't seen the low of the drop from this morning's high yet, especially since it started from the high of a long trading range. Such moves typically go back to near the low of the trading range before they end.

So I now expect the drop from this morning's high to assume a typical three phase structure, with the second phase rally carrying the market up to 1312 or so. I am looking for the third phase to end near 1304. Once it is complete the next swing should carry the market to 1328.

No comments:

Post a Comment