As you know I have been following the evolution of several possible versions of

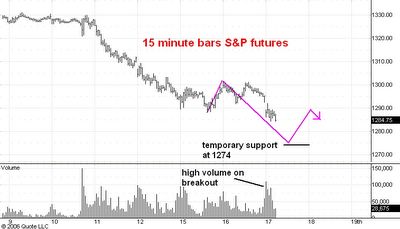

George Lindsay's 3 Peaks and a Domed House formation over the past two years. The chart above updates my views about the status of the domed house which started from last October's low of 1168 in the cash S&P 500.

The standard time projection for the peak of the domed house (point 23 in the

template you can find in this post) is that point 23 will occur 7 months and 10 days after point 14. In the present case this works out to June 5. At the moment the best interpretation I can make is that point 23 was in fact the high we saw on May 5 and that it will be point 25 that will be timed by the 7 month and 10 day period.

This will give the whole dome (points 21, 23, and 25) a lopsided appearance (i.e. it slopes down and to the right) but Lindsay often said that every example of a domed house tends to depart in some way from the template.

The real issue is whether or not the 1326 high at point 23 was the end of the bull market which started from 768 in October 2002.

My own view is that the

bull market is not over. Here's why.

First, the drop from point 23 has stayed within

normal bounds for a correction within this bull market. I don't see any reason based on the weekly chart action to think the sequence of higher lows formed by successive intermediate term lows has been or will be broken.

Second,

as I discussed in this post, I think Lindsay basic advances started from the October 2004 and from the April 2005 lows. I thought that these might end early in June 2006 thus making both subnormal in duration. However we have seen a long series of basic advances over the past 8 years that has alternated between extended and subnormal durations. This is a very long sequence of alternating lengths I am beginning to think it might now be broken. If so the current basic advances may well last well into this summer or fall and be simply normal in duration.

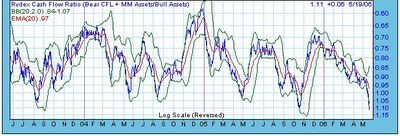

Finally, I see an awful lot of bearish sentiment develop on what so far has been only a 6% drop from highs made less than 3 weeks ago. This suggests the drop is almost over, not just starting.

I have sketched in two possible completions of the domed house. My favored version places point 25 as the end of a second phase rally from lows the market is making this week. Point 26 then ends the correction and is followed by a new bull market high as point 27 at 1350 or higher. Then the final break of the domed house develops which should carry the market down below point 10 (1168) and probably down to the start of the entire 3 peaks and domed house formation (the 1060-1100 range).

If I am wrong and the bull market really has ended then point 27 will develop somewhere below point 23 but the ultimate downside target will be the same.

There is an additional reason for thinking that the bull market high will come at point 27, not point 23. On the chart I have noted in red numbering a minor version of a three peaks (red 3, 5, and 7)and domed house which is still less than half complete. What will be point 26 in the major formation will be point 10 in the minor one. The domed house advance normally carries the market above the highest of the 3 peaks. Thus point 27 in the major formation would correspond to red point 23 of the minor formation and should be a new bull market high.